- MGM Resorts has reached an agreement to sell the operations of the Gold Strike Tunica to Cherokee Nation Entertainment Holdings in a deal worth $450 million USD.

- Cherokee Nation Entertainment Holdings owns the Hard Rock Tulsa Casino along with nine other gaming properties in Oklahoma.

- MGM will retain the Beau Rivage Resort & Casino in Biloxi, Mississippi.

MGM Resorts has made no bones about their desire to offload some of their excess gaming and hotel capacity. Late last week, they announced they had reached an agreement to sell the operations of the Gold Strike Tunica in Tunica, Mississippi to Cherokee Nation Entertainment Holdings in a deal worth $450 million USD. MGM will also receive a reduction in their annual rent to VICI Properties by $40 million USD when the deal closes in early 2023.

The fortunes of the Tunica gaming industry have been on the decline for over a decade. I wrote about the decline of Tunica earlier this year:

Mississippi is significant as it was the first decent casino ecosystem outside of the traditional strongholds of Nevada and New Jersey. The original epicenter for Mississippi casinos was Tunica, just under an hour south of Memphis, Tennessee. For a while, Tunica was the third largest casino market in the US behind Las Vegas and Atlantic City but that is no longer the case. Employment in Tunica casinos is now less than one third of what it was ‘back in the day’. The ‘party line’ is that it fell victim to the expansion of gaming nationally and that is certainly part of it. What is mentioned less frequently is the mismanagement of the state’s gaming industry by Mississippi politicians and regulators. In 1985, the Rev. Jesse Jackson gave Tunica County the charming sobriquet of ‘America’s Ethiopia’ though not inappropriate since 29% of the residents live in poverty. The situation is somewhat better on the Gulf Coast where Biloxi and surrounding areas have a dozen or so casinos.

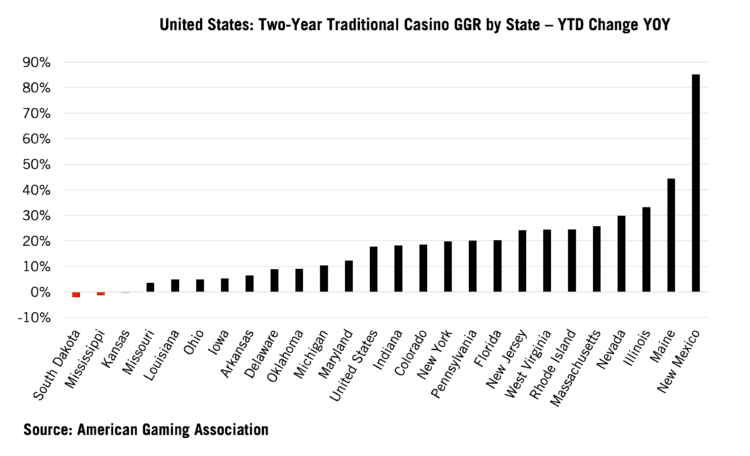

Mississippi is one of only three gaming markets in the US that has seen a revenue decline from 2021 to 2022. They also registered the largest casino visitation decline of any of the states that track this information (only five do):

Casino visitation levels were down year-over-year in April in four of the five states that report admission data (IL, IA, LA, MS, MO). Mississippi casinos registered the largest decline (-12.9%) while Illinois casinos welcomed the highest number of visitors – 806,302 – since before the pandemic. Compared to pre-pandemic levels, visitation was down in April an average of 12.3 percent across the five states.

The American Gaming Association (AGA) kindly blames Mississippi’s struggles on ‘the difficult year-over-year comparisons’ of the gaming industry’s rebound following the removal of COVID restrictions in 2021:

Through April, nearly all commercial gaming states are tracking well ahead of where they were at this point in 2021. Bucking that growth trend is the idiosyncratic D.C. sports betting market (-32.0%), as well as Kansas (-0.3%), Mississippi (-1.2%) and South Dakota (-1.6%) that are down by low single digits from last year’s pace. Increasingly difficult year-over-year comparisons were felt heavily in legacy casino markets Mississippi and South Dakota and reflect the strength of the consumer gaming market in spring 2021 as operating restrictions were lifted.

The biggest ‘legacy casino market’ in the US–the state of Nevada–has done just fine so maybe this *isn’t* the problem in Mississippi. The state has retail sports betting but refuses to expand it to online/mobile access. There are a few clear thinking legislators that understand its importance but so far that hasn’t been enough to get it done:

The most galling element of Mississippi’s backwards gaming regulation is the absence of statewide mobile betting–due primarily to the large population of fundamentalist religious nuts. You’d think that in the state with the highest poverty rate in the country (20.3% as of 2019) there would be some interest in anything that would give the job market a boost. Guess again–the state’s Bible thumpers would rather see the citizens of Mississippi in poverty. Not a coincidence that religion has always found ways to exploit and extract money from the struggling underclass. Mississippi’s casinos offer retail sports betting but not mobile betting–and mobile betting is what drives the bulk of revenues. In August 2021, Mississippi’s sportsbooks wrote just over $4 million USD holding just under $640 thousand USD. That’s a solid win percentage of 15.8% but produced negligible revenue for the casinos and even less tax revenue for the state. A mere 51 thousand ended up in the state’s till. That same month, West Virginia–a state with over a million fewer residents and far less tourism than Mississippi–did $22.3 million USD in sports betting handle. $16.6 million USD came from online sources and with only a marginally higher tax rate (10% to Mississippi’s 8%) the state pocketed $199,338 USD.

The Tunica area at least has a theoretical market in the greater Memphis area to draw from. There’s no casino gambling in Tennessee and no retail sportsbooks. The state also has arguably the worst regulatory framework for online betting of any US jurisdiction. Then again, you can’t blame the locals for not wanting to make the 45 minute drive to what Jesse Jackson once called ‘America’s Ethiopia’.

Down on the Mississippi Gulf Coast, the situation is better since there’s an actual tourism industry there. That’s why MGM Resorts is retaining the Beau Rivage property in Biloxi. Tunica, on the other hand, might be a lost cause. At one point, there were eleven different casinos operating in the Tunica area. There are now six–in addition to the Gold Strike there the 1st Jackpot Casino Tunica, Fitz Casino Hotel, Hollywood Casino Tunica, Horseshoe Casino Tunica and Sam’s Town Hotel & Gambling Hall. With the exception of the Fitz Casino Hotel–it was purchased by Foundation Gaming & Entertainment after the demise of Fitzgeralds Gaming–the properties are owned by deep pocketed, nationally known players: Caesars Entertainment, Boyd Gaming, Penn National and until the aforementioned deal closes, MGM Resorts.

The Gold Strike opened in August 1994 as Circus Circus Tunica. It originally did not have a hotel but by 1997 the property’s operating income declined by 50%. That motivated Circus Circus Enterprises to build a 1,200 room tower hotel and other amenities. They also decided to go upscale, ditching the circus theme and rebranding as the Gold Strike Casino Resort. The property’s 31 story hotel tower was the largest building in Mississippi at the time of its opening. That says more about Mississippi than it does about the Gold Strike’s hotel. MGM Resorts acquired the Gold Strike in 2005, doing some more renovation work in 2009. The Cherokee gaming operators are hoping to expand their business outside of Oklahoma by picking up the Gold Strike along with the proposed Legend’s Resort & Casino in Arkansas. The Arkansas property is tied up in litigation so there’s no clue when–or if–it will open.

Bill Hornbuckle, CEO & President of MGM Resorts did a good job making it sound like the Gold Strike property was something of value:

“I want to thank all of our Gold Strike employees who have consistently delivered world-class gaming and entertainment experiences to our guests. Gold Strike is a wonderful property with a bright future ahead. Strategically, though, we decided to narrow our focus in Mississippi to a single resort – Beau Rivage – and dedicate more of our time and resources towards continuing to drive success at that leading, world-class resort and casino.”

Cherokee Nation Businesses Chief Executive Officer Chuck Garrett sounds hopeful that the purchase is a good investment:

“The opportunity to expand our gaming and hospitality footprint outside of the Cherokee Nation Reservation and into commercial markets like Arkansas and Mississippi is truly exciting.”

Expanding into new markets isn’t a bad idea but the Cherokee Nation gaming entity picked two of the worst ones in the US. I have no clue what will eventually happen in Arkansas but there’s a chance that the Legends Resort & Casino will end up being a massive money suck that never opens for business. The property is in Pope County which isn’t the worst place it could be located–at least by Arkansas standards. Sadly, the county’s 15.4% poverty rate gives them one of the lower poverty rates in the state. Four Arkansas counties have poverty rates over 30% including Lee County which leads the state with a 40% poverty rate.

Here’s what Jonathan Halkyard, CFO & Treasurer, MGM Resorts International, said about the deal:

“This is a great outcome for the Company as we are able to reprioritize future capital expenditures toward opportunities that will enhance the customer experience at our other locations. We appreciate VICI, as the real estate owner of Gold Strike, working constructively with CNE to facilitate a new lease agreement.”

VICI is the real estate management firm that owns the real estate of most of the MGM properties. From the sound of it, VICI will be entering into a lease deal with the Cherokee Nation once their purchase of the Gold Strike closes. That means that MGM Resorts gets to walk away from the grease fire that is Tunica and will bank $350 million in the process.

The Cherokee Nation knows how to run gaming businesses and has done a good job in Oklahoma. Their skills will be put to a severe test in a Tunica market that has very little in the way of upside. In 2000, Tunica did $1.5 billion USD in gaming revenues. In 2005, it was $1.7 billion. In 2019–the final year of the ‘pre-COVID era’–it had dropped to $582 million USD.

One significant risk now is that MGM’s departure will set off a ‘chain reaction’ that will see the three other major gaming operators leave Tunica. MGM, Boyd, Penn National and Caesars all have properties on the Mississippi Coast which are much more viable. It also gives them a presence in the state should Mississippi ever join the 21st Century and offer online/mobile betting. The chance that any of these operators will make any significant investment in their Tunica properties are ‘slim and none’. I’d almost consider it a breach of fiduciary responsibility to put money into the area when it could be better deployed elsewhere.

If you live in Memphis–the only viable market contributing to the Tunica gaming industry–you can buy a non-stop ticket to Las Vegas on Spirit or Allegiant for around $200 USD. The question then becomes why would *anyone* go to Tunica? There’s nowhere to eat, no entertainment, no nightlife, no shopping. Just a half dozen casinos and a whole lot of poverty. Even Memphis BBQ fixture Corky’s bailed on Tunica years ago. Within a decade, Tunica will be a casino ghost town.