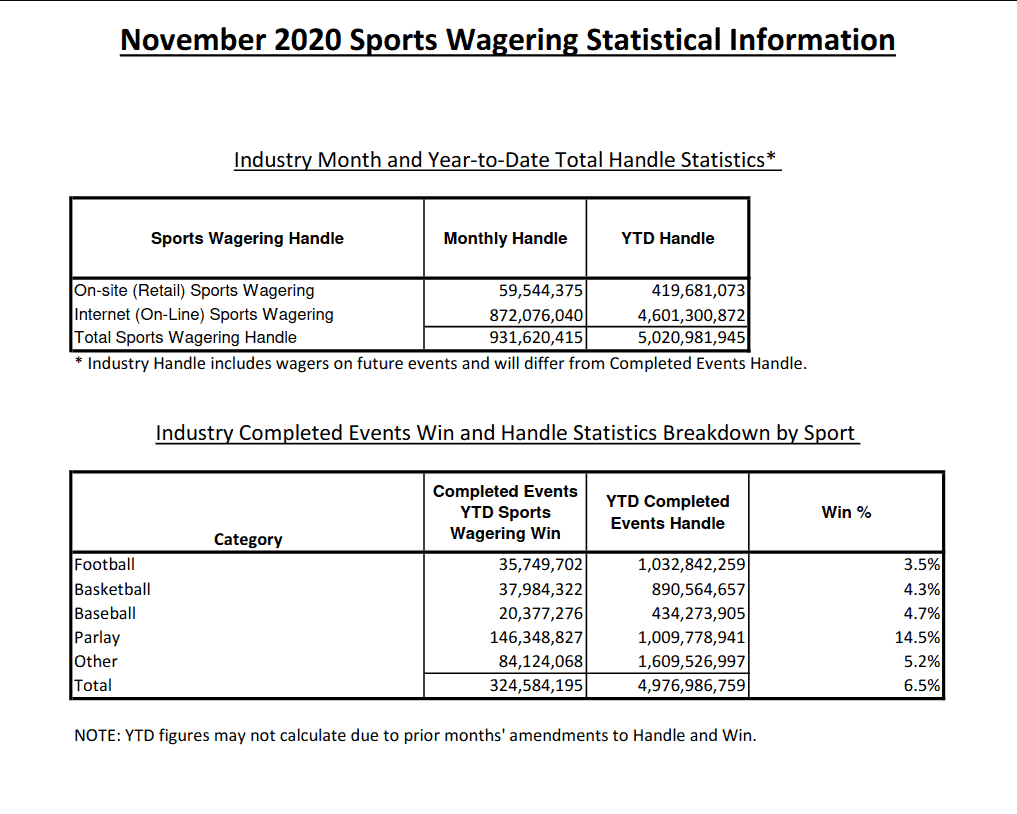

- New Jersey sportsbooks wrote over $931 million in action in November, 2020.

- It is the fourth consecutive month for record sports betting revenues in the Garden State.

- 93.6% of the November sports betting handle was online.

The combination of a great market and the regulatory framework necessary to leverage that has made New Jersey the dominant force in US sports betting. In November, the Garden State set an all time record for US monthly sports betting handle–the fourth consecutive month they’ve done so. After writing $803 million worth of action in October 2020 they came back with more than $931 million in handle in November.

By way of comparison, Nevada–which had a monopoly on US regulated sports betting for decades–has never done more than $614 million in one month (November 2019). In September, the Silver State took $572.2 million in action while New Jersey topped $750 million. Not only is Nevada lagging far behind New Jersey they’ve got plenty of company in the rear view mirror–for example, Pennsylvania did $500 million in October putting them on the cusp of supplanting Nevada as the country’s #2 sports betting market. Colorado is coming up as well though still well off the pace of the top states with over $200 million bet in October. Of course they’ve only been at it for six months in the middle of the COVID-19 pandemic.

Here are the revenue figures for New Jersey sports betting in November:

Perhaps the most compelling statistical takeaway from New Jersey’s huge month is the dominance of online betting. In November, 93.6% of the total sports handle was via online sources. In addition, overall sports betting handle grew 65% from November 2019–obviously there’s a confluence of factors contributing to that but the vibrant and highly competitive online marketplace in New Jersey played a significant part.

One of the primary reasons that New Jersey has left Nevada in the dust is due to simple demographics. New Jersey is the 11th most populous state in the country (8.88 million) and has nearly three times the population of Nevada, which comes in at #32 with just over 3 million residents (3.08 million). Nevada is definitely more reliant on tourism to power their gaming industry (sports betting and otherwise) but given New Jersey’s proximity to New York City they’ll get a nice bump from out of state visitors once the COVID-19 pandemic abates.

This salient component of the Nevada vs. New Jersey matchup notwithstanding, the Silver State has done a good job of digging their own hole. The ‘monopoly’ years made the state’s gaming industry complacent and consolidation resulted in the political and regulatory oversight bodies doing the bidding of a few big casino companies rather than operating in the interest of the state’s primary industry. Nevada still has the antiquated requirement that forces online betting customers to sign up in person at the individual sportsbooks. If you think that this requirement might be waived during the pandemic guess again–the in-person registration remained in place even as bureaucratic hellholes like Illinois did the right thing by their citizens and gaming operators.

For decades, Nevada sportsbooks–or more appropriately, the big gaming companies–had zero interest in competition or innovation. The gaming conglomerates had the state government run interference to put the kibosh on anything that deviated from the ‘old way of thinking’. The best example of this might be the megaresorts using the Nevada state legislature to take down the nascent betting kiosk industry back in the early 2010’s. Here’s what I wrote about it earlier this year:

At one point, Las Vegas was the undisputed ‘gaming capital of the world’ and that included sports betting. In the second half of the 20th century a variety of sportsbooks were able to lay claim to being the epicenter of the bookmaking universe. From Jimmy the Greek at the Las Vegas Sports and Turf Club, Bill Dark at the Del Mar, Bob Martin at the Churchill Downs Sports Book, Sonny Reizner at The Castaways, Gene Mayday at Little Caesars, John Quinn at the Union Plaza and Jackie Gaughan at the El Cortez to Bob Scucci and Joe Lupo at the Stardust, Johnny Avello at the Wynn (and now DraftKings) and Jay Kornegay at the Westgate Superbook there was no doubt that Nevada was the gold standard in sports betting.

Unfortunately, that began to change a few decades back. For a long time it looked as if Las Vegas would forever have a monopoly on retail sports betting in the United States and it hurt the city’s status as the ‘sports betting capital’ of the country, let alone the world. Aside from a few exceptions, innovation became a dirty word, competition became an even dirtier word and the betting industry in the Silver State started to wallow in mediocrity. The nadir was likely the campaign by the Nevada Resort Association and the legacy casinos to kill betting kiosks in the early 2010s. They let the state legislature take care of the kiosks run by William Hill and Leroy’s and although the money that the off site betting terminals generated were only in the hundreds of thousands of dollars they wanted to make sure to stifle the innovation before it got off the ground.

Nevada’s ‘innovation and competition’ gap is evident in the mobile betting component of the sports betting handle. Remember back a few paragraphs when we talked New Jersey doing 93.6% of their sports betting handle via online wagering? In September (the most recent month I have detailed breakdown data for) mobile betting in Nevada accounted for just 55% of overall handle. Of all the major sports betting states in the US, Nevada is the only one with a mobile betting marketplace that can be described as stagnant. Following the Caesars/William Hill merger, the William Hill buyout of CG Technologies and Treasure Island’s inexplicable decision to kill off their mobile app there are 9 mobile ‘outs’ available in Southern Nevada. If you don’t mind a trip to Reno you can sign up at the Atlantis and make it 10. That’s down from 12 mobile ‘outs’ in Southern Nevada a year ago and 13 statewide. Now Indiana (9 mobile ‘outs’) is right on the heels of Nevada in terms of mobile betting options. New Jersey (17) and Colorado (17) are in a different time zone completely.

Nevada still has a lot going for it including arguably the biggest concentration of sharp sports bettors, gaming executives, bookmakers, etc. in the United States. That edge is diminishing by the day, however, as opportunities open up elsewhere. Sports betting is one of the few segments of the gaming industry that has shown significant gain in recent years. The mobile betting situation is borderline desperate given that it is the biggest growth area in the industry. The status quo simply won’t work anymore assuming Nevada wants to stay relevant as one of the gaming capitals of the world. The next couple of years will be crucial for the Silver State and the gaming industry that stood as the ‘gold standard’ in the US for so long.