- US Federal Income Tax Returns are due by midnight on April 15

- 1 in 4 Americans are ‘afraid they’ll be audited’.

- In 2017 the IRS conducted 1.1 million income tax audits

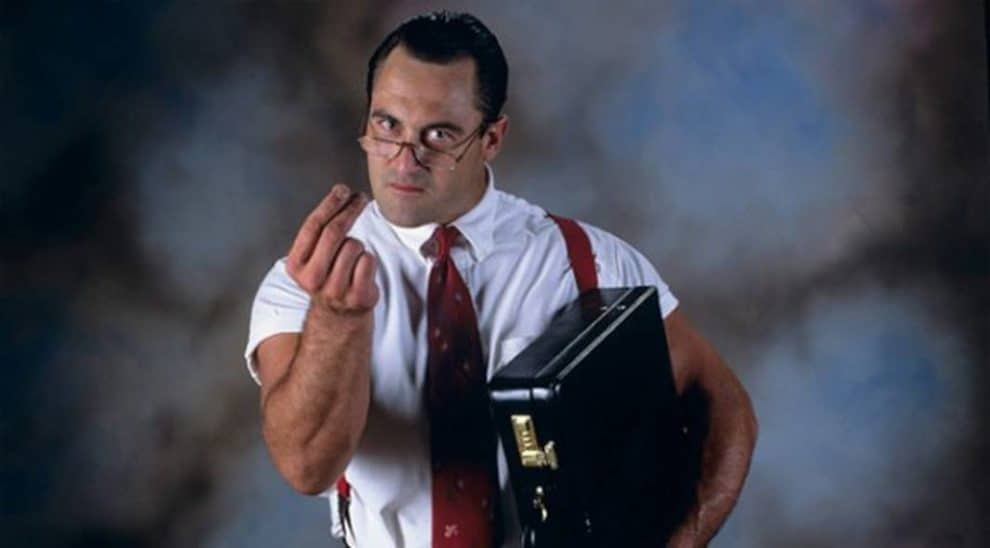

You can add ‘IRS Federal Income Tax Audit’ to the list of events that Americans are much more concerned about than they should be. People are terrified at the prospect of being audited. 25% of all Americans say they’re ‘afraid they’ll be audited’. For those over the age of 65 that percentage increases to 33%. Men are 12% more fearful of an audit than women.

Here’s the good news–the rate of IRS Federal Income Tax audits has never been lower. Thanks to a confluence of factors including budget cuts for the IRS the odds of being audited by the IRS had dropped from 1 in 90 at the peak in 2010 and 2011 to around 1 in 160 last year. The actual number varies from year to year but the official SPORTS INSIDER projections suggest that the audit odds for 2019 will be around 1 in 175.

YOUR ‘TRUE ODDS’ OF AN IRS AUDIT ARE DEPENDENT ON A NUMBER OF VARIABLES

If you’re one of the pinheads who send out tweets about how they’re ‘proud to be a taxpayer’ on April 15 because they’re all about ‘paying their fair share’ try this on for size–the IRS selection criteria is downright exploitative. The single variable that makes a taxpayer more likely to be audited than anything else? Claiming an earned income tax credit. 36% of all audits in 2017 were taxpayers who claimed the earned income tax credit. These are predominately the ‘working poor’–to claim the earned income tax credit you have to be earning under $20,000 per year. The logic here is simultaneously valid and disgusting–these taxpayers are less likely to know how to fight an IRS audit and/or have the resources to do so. These are the ‘little guys’ that big government advocates like to pretend their worried about. Government cares so much that they exploit their lack of education, information and resources. After all, endless wars and building prisons ain’t cheap!

If you make between $25 thousand and a $1 million per year your chance of being audited is less than 1/2 of 1 percent. If you make over $1 million your chance of an audit increases significantly. Between $1 million and $5 million your odds of an IRS audit are around 1 in 35. Between $5 and $10 million you’re looking at 1 in 17 and above $10 million you’ve got a 1 in 8 chance of being audited. The IRS targets the wealthy for essentially the same reason they go after the poor–the wealthy are more likely to just scratch out a check and be done with it. Try to start a business, work for yourself or leave the country and you’re painting a big bullseye on your back for the IRS in the form of increased risk of audit.

Here’s one good tip–in 2016 if you filed a paper hard copy return you had a 1 in 5 chance of being audited. If you filed an electronic return, it dropped to 1 in 200. Also, there’s a theory that filing an extension actually decreases your chance of an audit. Why is this? It is theorized that the IRS officers have an ‘audit quota’ that usually gets fulfilled during the rush of tax season. They just don’t have the same incentive to throw late returns into the ‘audit’ basket.

Here’s a chart comparing the odds of being audited by the IRS to an assortment of other events:

Odds of random events compared to the odds of a IRS Federal Income Tax Audit

| a NFL pass will be completed | 1 in 1.7 | ||

| an adult has a bank account | 1 in 2 | ||

| an adult will have sex within the next 24 hours | 1 in 17 | ||

| an applicant to Harvard is accepted | 1 in 18 | ||

| an adult is a vegan/vegetarian | 1 in 25 | ||

| meeting your spouse on a blind date | 1 in 35 | ||

| being selected to play on 'The Price is Right' | 1 in 36 | ||

| a man age 25 to 45 being a virgin | 1 in 45 | ||

| qualifying for Mensa | 1 in 50 | ||

| serving on a jury | 1 in 50 | ||

| an adult showers less than once a week | 1 in 100 | ||

| being killed in a car accident | 1 in 111 | ||

| being audited by the IRS | 1 in 172 | ||

| being born with 11 fingers or toes | 1 in 500 | ||

| catching a foul ball at a MLB baseball game | 1 in 1000 | ||

| bowling a 300 game | 1 in 11,500 |

Since we think in terms of betting odds here at SPORTS INSIDER we’ve compiled some moneyline odds on tax audits. These are the odds that a specific taxpayer–you for example–will be audited by the IRS under various circumstances:

2019 IRS FEDERAL INCOME TAX AUDIT BETTING ODDS

ODDS THAT AN INDIVIDUAL WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +25000

No -50000

ODDS THAT AN INDIVIDUAL FILING A HARD COPY (PAPER) RETURN WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +350

No -700

ODDS THAT AN INDIVIDUAL FILING AN ELECTRONIC RETURN WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +30000

No -60000

ODDS THAT AN INDIVIDUAL REPORTING NO INCOME WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +2500

No -5000

ODDS THAT AN INDIVIDUAL REPORTING INCOME BETWEEN $1 AND $25 THOUSAND WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +7500

No -15000

ODDS THAT AN INDIVIDUAL REPORTING INCOME BETWEEN $25 THOUSAND AND $50 THOUSAND WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +45000

No -90000

ODDS THAT AN INDIVIDUAL REPORTING INCOME BETWEEN $50 THOUSAND AND $75 THOUSAND WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +37500

No -75000

ODDS THAT AN INDIVIDUAL REPORTING INCOME BETWEEN $75 THOUSAND AND $100 THOUSAND WILL BE THE SUBJECT OF AN IRS FEDERAL INCOME TAX AUDIT

Yes +40000

No -80000